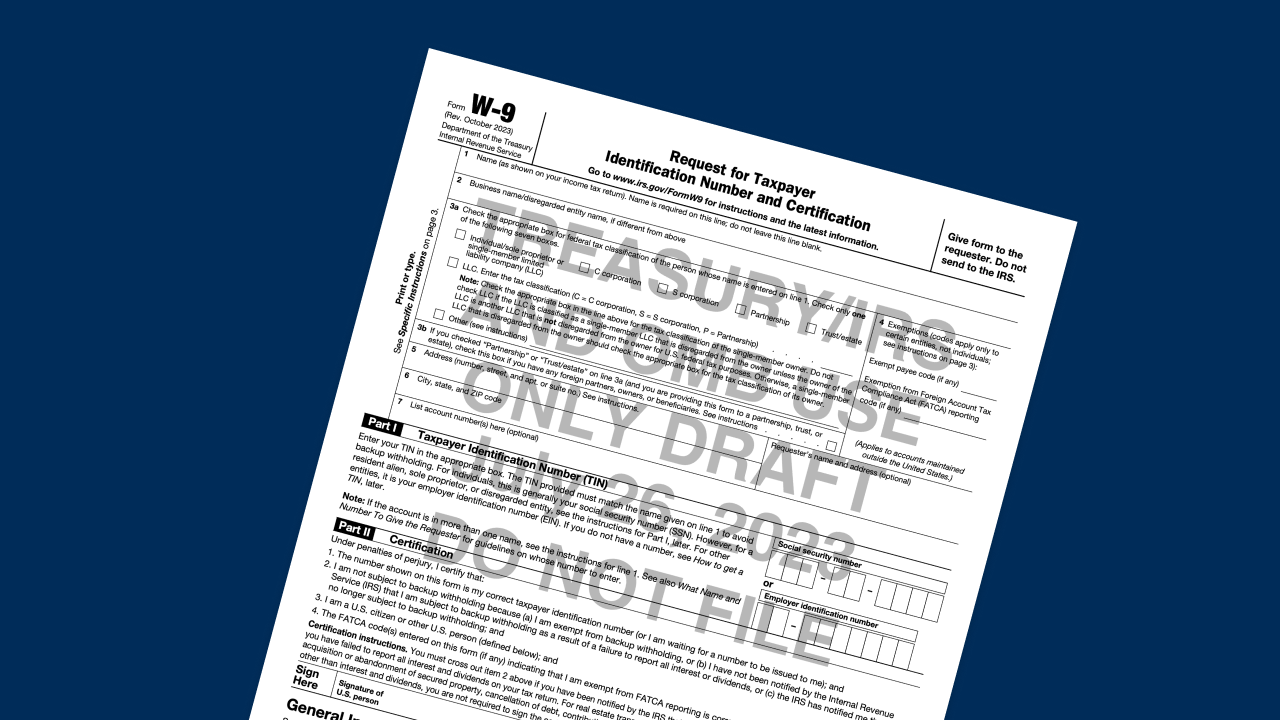

On July 26th, 2023, the IRS released a draft of the 2023 revision of Form W-9, “Request for Taxpayer Identification Number and Certification,” that includes a new reporting line for flowthrough entities like partnerships and trusts. The draft 2023 revised form adds a new line 3b, adding an additional checkbox for entities that select “partnership” or “trust/estate” on line 3a (current line 3) that are providing the Form W-9 to a partnership, trust, or estate. The form instructs these entities to check the box in line 3b if they have any foreign partners, owners, or beneficiaries.

How Soon Will the Changes Take Effect?

The October 2023 revision of Form W-9 (Form W-9 (Rev. October 2023) (irs.gov)), once marked Final, will allow for a transition period where the validation of the prior revision (2018 version) will be accepted for up to six months. After this transition period, only the 2023 version will be acceptable. The earliest to take effect would be October 2023, meaning latest date to adopt would be May 1, 2024.

What is the Purpose of the Change?

The IRS explains that the change is intended to give flow-through entities information regarding indirect foreign partners, owners, or beneficiaries for purposes of complying with relevant reporting requirements. This includes requirements for partnerships with indirect foreign partners to complete Form 1065 Schedules K-2 and K-3.

The draft Form W-9 has a revision date of October 2023. Once finalized, withholding agents are generally required to accept the current version Form W-9.

Some organizations have already provided comments to the IRS on the draft October 2023 revision of Form W-9. The Securities Industry and Financial Markets Association (SIFMA) provided comments on the draft October 2023 revision of Form W-9 relating to new line 3b (regarding foreign partners, owners, or beneficiaries). SIFMA proposed updating the instructions for line 3b to clarify that the new checkbox is not required in the circumstances where a withholding agent is receiving a Form W-9 from an account holder (e.g., to open a deposit or custody/brokerage account) or a payee (e.g., regarding vendor fees for services).

At Nextform, we are committed to supporting all tax form revisions and ensuring that our clients are always up to date with the latest changes. We are currently working on updating our platform to align with the recent changes to the drafted W-9 October 2023 revision.

If you collect a lot of W-9’s, you have probably found that verifying the information on the form and keeping track of who has provided one (and when) can be a challenge. Nextform automates collection, tracking, and record retention for Form W-9. See for yourself with a free account.